I will going away for the next two weeks. While I will be lugging around my newly-purchased MacBook, I doubt I will have the opportunity to write out any 'profound' material related to this blogs' interests, although I might be tempted to post some snapshots and general travel commentary; but don't count on it.

I know my output volume has been dropping to historic lows, but this is simply the result of an increased output into other activities: reading, movies, studying, and of course, towards the disutility of labor (one must find a way to pay for his expensive computer toys, no?)

Peace and Anarchy Out!

-iceberg

Tuesday, May 23, 2006

Tuesday, May 16, 2006

comparing apples to non-apples

Being an aficionado of most-goods Apple, it usually means that I come across some industry analyst opinion piece which attempts to compare Apple Computer Corp.'s offerings to those of the rest of the industry util-to-util.

Being an aficionado of most-goods Apple, it usually means that I come across some industry analyst opinion piece which attempts to compare Apple Computer Corp.'s offerings to those of the rest of the industry util-to-util.While the money price is the indicator most of use to make comparisons of utility in the indirect-exchange economy, for better or worse, the money price is usually the only cost taken into consideration by these analysts.

The problem with that of course is that while you can compare physical features, dollar-to-dollar, you cannot easily integrate the psychic benefits provided into your utility comparison.

For instance, what price can an analyst quantify which would measure the benefit of not having to deal with computer trojans and viruses and the resulting peace of mind associated with that?

How many utils do you get from the use of a superior operating system which works as designed, hiberbates and awakes instantaneously, and almost never, never, ever crashes?

How do you compare the sheer aesthetic bliss from a unified graphical user interface, the ease of controlling its functions, and the neat integration of hardware to software (iPod <--> iTunes; iSight <--> iChat, PhotoBooth, iMovie; Apple Remote <--> FrontRow, etc.) ?

How do you compare the sheer aesthetic bliss from a unified graphical user interface, the ease of controlling its functions, and the neat integration of hardware to software (iPod <--> iTunes; iSight <--> iChat, PhotoBooth, iMovie; Apple Remote <--> FrontRow, etc.) ? To ask those questions are to answer it, and the fact that Apple is sucessfully selling computers, and most importantly, profitting from their operation, proves that to the contrary of naysayers, Apple is providing a good which satisfies the consumer demand for computer equipment preferred over the next best alternative.

To ask those questions are to answer it, and the fact that Apple is sucessfully selling computers, and most importantly, profitting from their operation, proves that to the contrary of naysayers, Apple is providing a good which satisfies the consumer demand for computer equipment preferred over the next best alternative.What I'm not saying is that price comparisons are entirely irrelevant; rather that I am attempting to stress that there are other values here, which although they cannot be legitimately quantified, they are at best approximated in the money price, and will require the economic actor to subjectively assess the ordinal utility so as to make the correct purchasing decision. However, to simply compare dollar value is a bogus operation, which yields the same in results (the GIGO rule)

I am neither a sociologist, nor a psychologist by occupation, but I would hazard that this erroneous view of what money is, emerged with the appearance of bank notes, and later reinforced by the unbacked, fractional-reserve type into what people believe it ought to be, but isn't.

Money we know, is a good we use mostly for its exchange value, but before that it first had to be desired for its use value. Precious metals, because of their relative scarcity, their durability, the ease of storage and divisibility historically led to it's wide-spread adoptance as money, the common-denominator good, which many people are willing to exchange for other goods, and to hold onto for later exchange. Logically it follows, that the more of it you have of this good, the more of it you can exchange for other goods for the benefit of your ultimate consumption.

The other side of the coin, so to speak, is the portability of money. Gold, although highly desired by many, is difficult to use in everyday, small transactions. Sure you can clip a coin into pieces, but it was rarely done so very accurately. Others still used gold for small transactions, by having ground into a fine, easily divisble dust, which had to be carefully tied up in a kerchief until you were rung up at the dry goods store's register.

Another problem you would encounter is that of safety. Clinking coins in your pocket or bag is a loudly announced appointment with your local cutpurse. And although a bullion can buy you practically anything, should it be misplaced or stolen, it will represent a very heavy loss of exchange upon the lossee, thus being a burden on the sound mind and wits of the holder.

To counter those problems, the notion of banks evolved, whence you would deposit your valubles, and recieve a warehouse receipt that acknowleged it. Indeed, you payed the bank for the privilege of safeguarding your money stock. Now, instead of lugging along a gold bullion to buy a house, you would simply hand the seller the receipt to the same good, giving him title to 'one gold bullion' at So-and-So Gold Warehousing Extraordinaires & Co.

Unfortunately, it was at this point, that along with convenience of light-weight paper specie, came the abstraction of money, psychologically setting it apart from other goods. It's now common belief that if you duplicate the paper certificate, you can create goods out of thin air (for practical consideration, please observe the Federal Reserve and the lesser smalltime counterfeiters who operate under this fallacy.) Due to my involvement in the real estate industry, I first observed signs of this fallacious nominal illusion, or the "nominallusion" as I like to shorten it.

The nominallusion is the faith by those who believe, that when you have a lot of numbers attached to a real estate transaction, it's indicative that the value of the transacted property has risen astronomically, when in fact, the value may have dropped in real terms, and it's only that the price of money has fallen significantly in real terms. However, the dogged insistence of comparing a historic price with present prices and arriving at such conclusions of value, when the vehicle of comparison (money prices) has been so tampered with as to make the information conveyed utterly useless, is quite and regrettibly pervasive.

The potential of moral hazard only looms larger under such illusions, especially when artificially low-interest rates spur entreprenuers and financial institutions into collosal malinvestment of capital.

To correct this mass delusion, we would have to educate-away the primitive nominallusion of money, and to reintroduce the concept of sound money. Until that time, we have the blind leading the blind in their quest to objectively compare apples to apples.

Saturday, May 06, 2006

funcusion

Oftwhile, in the heat of internet discussion, one may be called out for not being "practical" and "realistic", as though the lack of an empirically encountered basis should bear significance when discussing both the ethical principles which are being ignored, and some of the overlooked ramifications of unsound policy.

For example, free marketeers are often asked of to prove the hypothetical posed by their understanding of economic theory. They ask, "Iceberg, where do these mythical unzoned cities exist?" or one of the old standard canardic "what if's..." followed by what they think is an unsolvable problem which would hence justify state sponsored aggression because they are incapable of thinking the 'problem' through.

As the topic of real estate is within the area of personal interest, my participation on preeminent R.E. blogs makes certain that no harmful governmental policy goes uncriticized and scorned.

Such was the case more than once this week. One may witness the full exchange here of one such discussion, but here were my final words:

In a later post, someone labeled me a "free market Pollyanna", which is to say "a person regarded as being foolishly or blindly optimistic".

This title which I find humourous, probably stems from the mistake that we libertarians, like everybody else in the political world, have a "correct" answer to all issues and problems.

As we all know, it's certainly not the case.

The correct answer is that we don't know all the answers to all the "problems". We can't be sure if they are even problemetic. And we certainly don't think that government is the best vehicle to solve these "problems".

In any case, I wrote back:

For example, free marketeers are often asked of to prove the hypothetical posed by their understanding of economic theory. They ask, "Iceberg, where do these mythical unzoned cities exist?" or one of the old standard canardic "what if's..." followed by what they think is an unsolvable problem which would hence justify state sponsored aggression because they are incapable of thinking the 'problem' through.

As the topic of real estate is within the area of personal interest, my participation on preeminent R.E. blogs makes certain that no harmful governmental policy goes uncriticized and scorned.

Such was the case more than once this week. One may witness the full exchange here of one such discussion, but here were my final words:

I humbly await further explanation of your comments, as I have difficulty understanding what exactly is unrealistic, and why pragmatics matter in discussion of economic or urban theory.

The entire point of discussing theory is to engage in hypothetical and counterfactual speculation, to try and better understand if society is better or worse off due to government intervention into the marketplace, in its regulation of zoning, usage, landmarks, aesthetic, and construction method & materials.

There are reasons to oppose these regulations. First, because they tend to reward certain parties (those with lesser restrictions) at the expense of those parties with higher restrictions.

The restrictions, on their very own raise the bar of entry, hence monopolozing the industry in favor of the firms who are best at cutting through the bureaucratic red tape (i.e. Rockefeller was notorious for his support of industry regulations, in which his firm was more able to implement than other firms, thus helping him drive out his competition with government fiat).

Second, recognizing that no one, or small group of people are all-knowing, it will be impossible for them to divine the far-reaching ramifications of the policies they enact. For example, do the proponents of downzoning take into consideration that they are the foremost cause of driving out the middle-class from the city? Will they be willing to make that trade-off if they knew upfront that the price of housing will go up by x and y amount of people will not be living here because of this narrow-minded policy?

Aside from the economics, I am not too concerned with the arguments calling for "livible cities" or "sustainable development", because first, their arguments are not grounded in reality, but rather emotion, and second, the fault, if any would lie at the doorstep of the prior government interevention which brought about the market aberration they detest. If anything, these people should be clammering for the deregulation of the market to straighten things, not to further strangle and distort them.

I also happen to believe that developers, just like everyone else, usually intend to stay in the game for long-term, and thus are driven toward long-term profitability as their goal, and not short-term embezzlement or fraud.

That being the case, it would only make sense for developers to build the most attractive, livible housing stock as possible. Why you ask, when they could just as well build shoddy housing?

Well, if you would engage in just a tad of hypothethicals, and imagine that there is no artificial limits to how much housing any developer can build, you must imagine too that he will have very serious competition.

Why would they choose developer A's units, when developer B will give them a better unit for the same price?

Hence, it goes to prove that by artificially limiting the amount of buildable space, one of the ramifications is that developers are not competing* anymore in terms of quality, since there is a monopolized stock of which they control, and which is difficult for another developer to mitigate (witness the attempt by the Jack Parker Corp. to increase the housing stock in the west village.) In essense, the government's meddling has both decreased housing stock, housing quality, raises the prices, and later the costs, and the crowning glory- it makes the neighborhoods unaffordable to the middle and lower classes.

*In essense, we have a "market failure" even though the failure was caused by government intervention in the first place.

In a later post, someone labeled me a "free market Pollyanna", which is to say "a person regarded as being foolishly or blindly optimistic".

This title which I find humourous, probably stems from the mistake that we libertarians, like everybody else in the political world, have a "correct" answer to all issues and problems.

As we all know, it's certainly not the case.

The correct answer is that we don't know all the answers to all the "problems". We can't be sure if they are even problemetic. And we certainly don't think that government is the best vehicle to solve these "problems".

In any case, I wrote back:

Thank you, I will take that as a compliment coming from a monomaniac who makes false pretentions as to the astuteness of central planners who must be omniscient in regards to all the far-reaching effects of their policy recommendations.I thought it appropriate that the very day before, Manuel Lora's "Libertarians Are Not Socialists, Prophets, Omniscient or Specialists in Everything" appeared on LRC, and here is my favorite bit:

If anything, I'm the one who is claiming not to have advanced or absolute knowledge of optimal urban planning. Anyone who claims it is possible, is the greater pollyanna and falls into the category of maintaining 'fatal conceit'.

The problem starts when the "viability" of freedom becomes contingent upon the "answer" to those questions. That is, if the "right" and fully satisfactory answer is not achieved (ignoring that no such answer could ever be 100% correct), then somehow the desire for liberty is lessened and statism creeps back in.

"How would roads work? How can a flu pandemic be prevented? What about organ trafficking? Would we need car insurance? How much? Who would determine that? What if drugs are cheap and widely available? I don’t want people to have AK-47s! What about licensing and standards? If everyone can make their own money, then it’s going to be chaos!"

So let me answer the question as clearly as I can. I am not a socialist!

Wednesday, May 03, 2006

an offer he couldn't refuse

I know this is but a tad late, but I couldn't help but post this little tidbit:

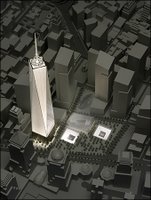

There was a recent breakthrough in the negotiations between the World Trade Center (WTC) leaseholder Larry Silverstein and the triumvirate of government. Just so we don't miss anyone, these parties would be

a) the Port Authority of NY & NJ,

a) the Port Authority of NY & NJ,b) the New York City government, its dictator, and its wholly-owned subsidiary, the Empire State Development Corporation

c) the clowning-glory, Governor Pataki and his goons, er.. administration

Basically, the story is that Mr. Silverstein was presented with two choices by the thugs-in-office:

A) Take this pittance of cash, give up your lease and walk away from the site

B) Give up ownership for the main site, and we will let you keep and build the few other sites, and even allow you to build the main site for us.

Of course, unmentioned as always was the threat of using eminent domain which only allowed Mr. Silverstein to choose between A or B, instead of perhaps C, which funnily was never mentioned.

Choice "C" was of course, recognizing that the property in question belongs to Mr. Silverstein, who clearly did not find either of the other two "choices" to be sufficiently appealing.

Choice "C" was of course, recognizing that the property in question belongs to Mr. Silverstein, who clearly did not find either of the other two "choices" to be sufficiently appealing.The weird thing is that the press never saw through this sham, and somehow treated it as though Mr. Silverstein is the party who is unwilling to negotiate, and therefore is an obstinate, unsavory character, perhaps undeserving to be the one chosen to build the Freedom Tower.

Although the eminent domain process was not used, the mere threat of using it accomplished the same result, which was to force a landowner into a deal that he was not interested in.

I guess this all goes to show that it's not the Onion, but rather government which is the greatest source of satire and irony, ever. After all, if the "Freedom Tower" is ever built, it will be on lands with a history of private property violations.

I guess this all goes to show that it's not the Onion, but rather government which is the greatest source of satire and irony, ever. After all, if the "Freedom Tower" is ever built, it will be on lands with a history of private property violations.

Monday, May 01, 2006

escaping the state

If I had the use of a time traveling machine, I could imagine going to meet an earlier version of myself. I'm sure I would try to engage my past self why in the future I began to fervently hate the state and why I support abolishing it. I'm afraid to admit it, but I believe that my earlier self would dismiss my future self as imbalanced and insane. In short, I wouldn't know how to recreate the act of getting my past self to be understanding and sympathetic to my future self's views, even though I will know that it's entirely possible since it already has occurred once before.

Thinking back on my own "enlightenment", of how I broke through and cast off the shackles of the state from my mind and conscience, I would only like to extend this courtesy to my fellow human beings. The question I guess has always been how to accomplish this.

I've only heard of one major attack against this meme; cognitive dissonance. The hope is that if one constantly points out how the state acts immorally, that most people will wake up to this and finally realize what really irks us libertarians.

The only other idea I've heard so far is Vache Folle's "Re-education Camps", which admittedly sounds like a reasonable proposal, due to the fact that it will only be consistent with the morality of the people jailed inside it. Once the inmates transcend the enslaved morality of statism, they will be free to come and go as they please. This I believe is 100% compatible with libertarian ethics, which operates similarly in the regard of which we would be acting consistent to treat thieves and murderers with the same principles they espouse (i.e., using force or coercion to take back one's property or compensation.)

Other than that, I've only recently been cognizant of the parallel between statism and the history of African slavery while reading Thomas DiLorenzo's The Real Lincoln. Now imagine yourself living 150 years ago. If you hold similar values to my own, you would probably support the Abolishment party's goal of ending slavery, although I couldn't tell you if I'd agree with the why this group were against slavery, the means they proposed to end it, and perhaps other political baggage that the group members supported.

Other than that, I've only recently been cognizant of the parallel between statism and the history of African slavery while reading Thomas DiLorenzo's The Real Lincoln. Now imagine yourself living 150 years ago. If you hold similar values to my own, you would probably support the Abolishment party's goal of ending slavery, although I couldn't tell you if I'd agree with the why this group were against slavery, the means they proposed to end it, and perhaps other political baggage that the group members supported.

Anecdotally, we find that many slaves themselves (colloquially, "uncle toms") inexplicably supported the very institution which oppressed them. I'm hoping that with a proper psychoanalysis of the many different individuals in America's history, we can begin to understand this desire to be enslaved.

Once before on this blog have I scoffed this mental illness as sadomasochism, but this in no way explains why it's the prevailing mentality, and more importantly, how it can be cured.

Listen, I'm all ears.

Thinking back on my own "enlightenment", of how I broke through and cast off the shackles of the state from my mind and conscience, I would only like to extend this courtesy to my fellow human beings. The question I guess has always been how to accomplish this.

I've only heard of one major attack against this meme; cognitive dissonance. The hope is that if one constantly points out how the state acts immorally, that most people will wake up to this and finally realize what really irks us libertarians.

The only other idea I've heard so far is Vache Folle's "Re-education Camps", which admittedly sounds like a reasonable proposal, due to the fact that it will only be consistent with the morality of the people jailed inside it. Once the inmates transcend the enslaved morality of statism, they will be free to come and go as they please. This I believe is 100% compatible with libertarian ethics, which operates similarly in the regard of which we would be acting consistent to treat thieves and murderers with the same principles they espouse (i.e., using force or coercion to take back one's property or compensation.)

Anecdotally, we find that many slaves themselves (colloquially, "uncle toms") inexplicably supported the very institution which oppressed them. I'm hoping that with a proper psychoanalysis of the many different individuals in America's history, we can begin to understand this desire to be enslaved.

Once before on this blog have I scoffed this mental illness as sadomasochism, but this in no way explains why it's the prevailing mentality, and more importantly, how it can be cured.

Listen, I'm all ears.

Subscribe to:

Comments (Atom)